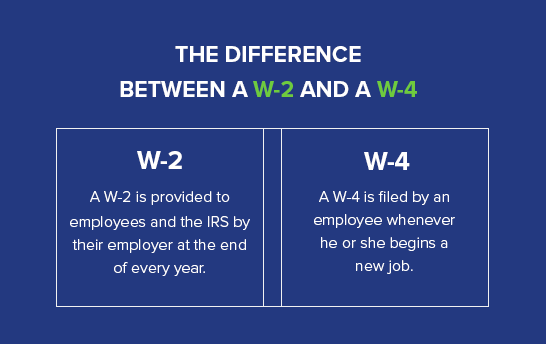

Both W-2 and W-4 forms are the basic need of every employee who is going to pay tax to the government. W-2 and W-4 forms are considered IRS (internal revenue service) forms, which help in analyzing the taxation system at the end of every year. Every employee has to submit forms at the end of the year to determine the payroll and recompense remuneration.

What is the W-2 form?

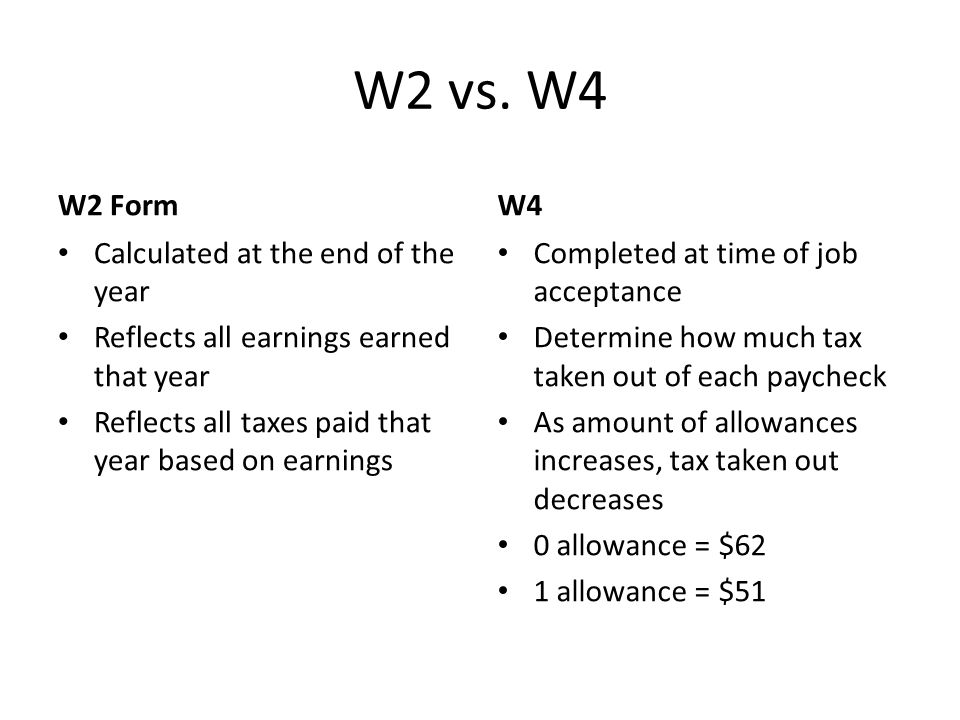

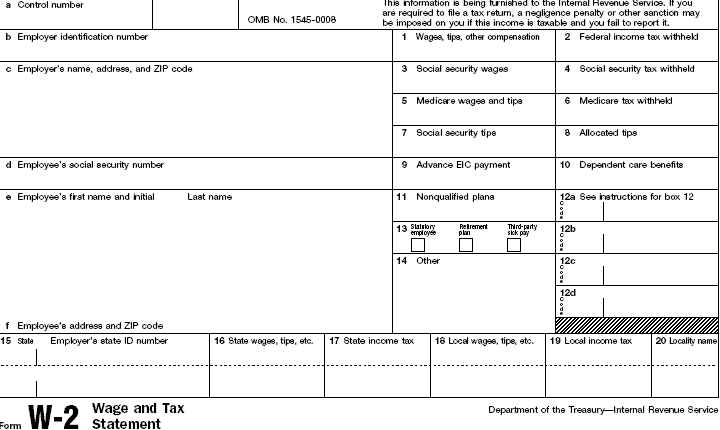

The W-2 form was filled and submitted at the end of the year by an employee and it demonstrates the amount value that was withdrawn. There is a requirement to make copies of form W-2 forms both to IRS and to employ to find out the total amount withdraw and the amount recompense remuneration. In W-2 form include the salary and tax details of every employee.

What is the W-4 form?

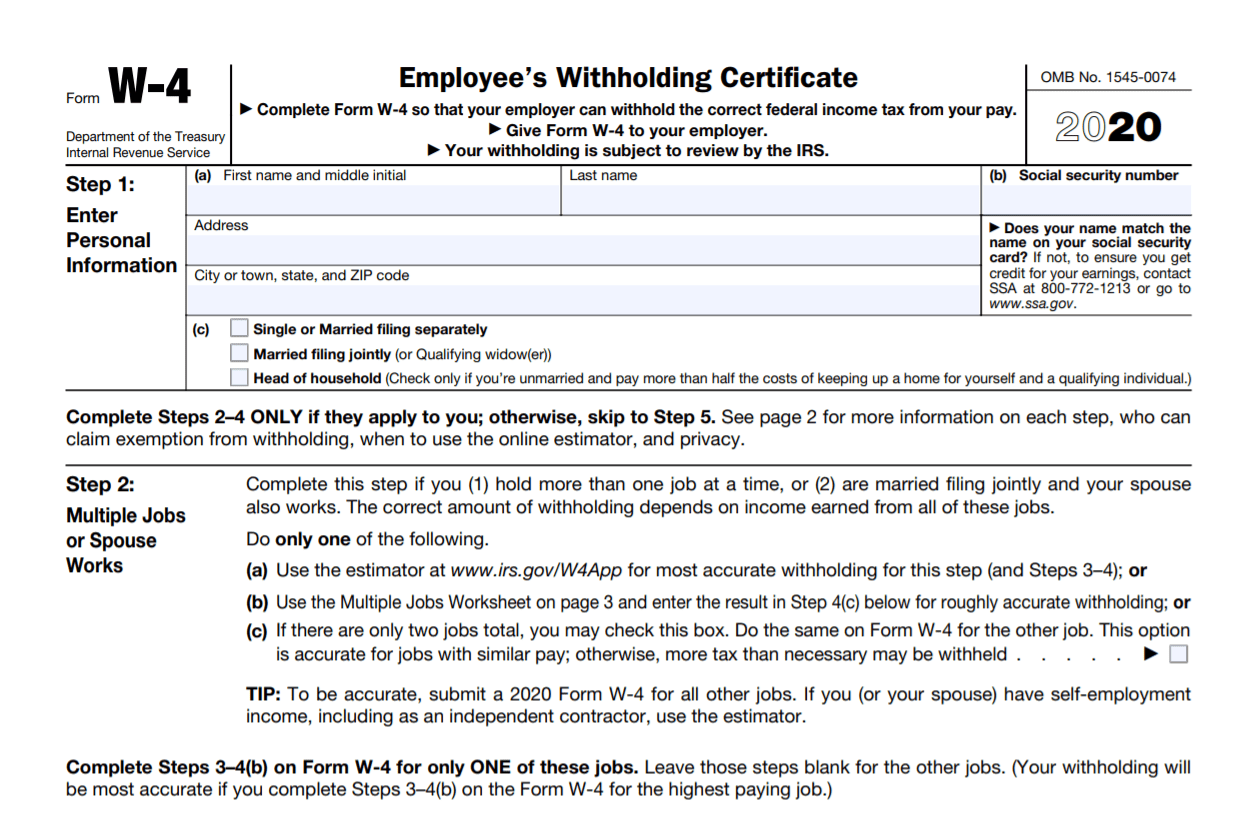

W-4 forms are used by newly joined employees to estimate how much tax employers have to withdraw from their payroll. Every employee has to submit the W-4 form to talk about how much tax has to withdraw from their salary based on various factors like personal exemption, expected tax incentives, family members’ dependence, and wee as payroll tax. Based on employee choice the W-4 has to design and submit to the IRS department. The experienced employee also submits form W-4 form if there are rectifications and changes. In the W-2 form need to enter details related to the financial status and dependence of family members.

The W-4 forms are also called employees withholding allowance certificates.

Here we are going to explain the difference between W-2 and W-4 forms in a detailed manner, both forms are considered IRS forms.

Difference between form-2 and W-4

About W-4 form: the w-4 form include details about PayScale and withdrawal. How much which are withdraw from salary is explained in the W-4 form. This form helps employees to determine the specified tax payments and report to IRS buy transferring amount.

About W-2 form: in W-2 form include employee salary and tax hold on it. this form includes complete details about salary and tax based on annual. W-4 gives the statement related to PayScale and taxes. It’s all about statements and records of payroll and tax.

The purpose of using W-4 and W-2 form

About W-2 form: the purpose of filling W-2 form is to know each employee details which is related to retirement benefits and planning and also salary scale, rewards, annual and monthly income, bonus payments, government tax payment, medical allowances, medical secure as well as Medicare taxes.

In form W-2 an employee can design both present and feature by dividing annual income into several parts. W-2 shows an employee report about gross salary.

W-4 Form: the purpose of filling the W-2 form is to know details about how much amount will be withdrawn from each employee’s salary and the withdrawn amount will be sent to IRS, it is nothing but cutting the amount in payroll for a purpose of taxation. based on payroll, family status, the value will be affected.

What are you going to do with form W-2 and W-4?

About W-2 every employee has to submit it every year and also maintain the copies. Every employee has sent a copy of the w-2 form to SSA (social security administration) through send mails in the form of documents or by physically through hardcopy. Before 31 st January the employee has to submit the w-2 form.

About W-4 when we compare the w-4 and w-3 forms they have a big difference, there is a need to send the w-4 form to any institution but employees have to main either soft or hard copies of the w-4 app.

How complete the W-2 and W-4 form

About the W-2 form: base on the paysheet and taxes per year the W-2 form have to fill up with employee details in a detailed manner.

About the W-4 form: every employee has to complete the submitting W-4 form by mention details like allocations, payroll, and some other personal information.

When completing the W-2 and W-4 forms

About W-2: based on instruction every employee gave to submit the w-2 form every year, if an employee submitted the w-2 form in 2019 January and again needs to submit w-2 in 2020 January to maintain a record about taxes and wages in a clear way. Employees have to submit forms to IRS.

About W-4: whenever a new employee joining into the job needs to fill up the form w-4 must and should. This form helps in maintaining the further documents and to maintain the tax and wages reports and examining the taxes which is withdrawn with an employee salary. In between the first pay date the employees should submit the w-4 form to IRS.

Based on requirements and financial stats, the old employees also submit a new w-4 form to IRS to change the structure of the entire financial planning.

Conclusion

W-4 and W-2 forms are one of the most important things to every employee to main records which is related to taxes and wages in detail manner. In this article, we explain the difference between w-4 and w-2 in detail.