National Pension System scheme can be used by the people who are eligible to invest in the scheme. According to the rules of this scheme, the citizens of India who are 18 years to 60 years age can invest in the scheme. Before joining the scheme, the person should accept the know-your-customer (KYC) norms. After accepting the norms, a person can start investing in the scheme.

What is NPS?

The abbreviation of NPS is the National Pension System. This National Pension System is a scheme which is sponsored by the government. The amount of the pension you will be receiving in the future will depend upon the amount of the collection you do during the time of maturity schemes.

National Pension Scheme Calculator[NPS]

This National Pension system calculator will show you the collection which is made by you during the time of maturity. It will be helpful for us to know the amount of the pension you will be receiving every month. The amount that you will receive at the age of 60 can also be known by using this National Pension System. Every month, you have to contribute some amount of money to the NPS. If your invested money is more, then you will get the more assembled amount. Then the pension wealth will also be more.

Who can use the NPS calculator?

National Pension System scheme can be used by the people who are eligible to invest in the scheme. According to the rules of this scheme, the citizens of India who are 18 years to 60 years age can invest in the scheme. Before joining the scheme, the person should accept the know-your-customer (KYC) norms. After accepting the norms, a person can start investing in the scheme.

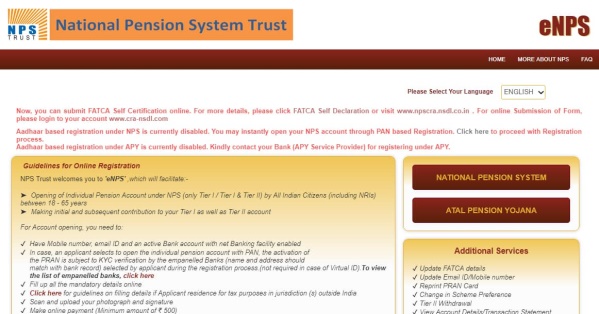

How to open the NPS account online?

NPS now started providing its services online. So the individual can generate their own PRAN and can start investing in the NPS online. This service is named as E-NPS. Any individual having net banking facilities can open their account in the NPS by choosing any of the options which are given below.

- By giving the PAN and KYC details that are provided in the bank.

- By providing the Aadhaar card details.

Steps to create the NPS account providing the Aadhaar

- Firstly, you need to enter your basic profile details.

- Then register with your Permanent Account Number (PAN) or Aadhaar number.

- The give the account as Tier-I or give it as Tier-I & Tier-II.

- Remember that your Aadhaar card and the mobile number registered with your Aadhaar because you will receive an OTP on that.

- Adding a nominee is the compulsory thing which you want to do.

- Then you need to upload the scanned signature and the photograph.

- Then move to the payment page.

- After the completion of the payment, the subscriber will be allotted with the PRAN.

- The PRAN kit will be sent to the subscriber after the completion of the registration. The subscriber should affix his/her signature and paste his/her photograph on the printout copy of the auto uploaded form.

How to use the NPS calculator?

To know about the collections made by you, the calculator should have the following details

- The calculator should have your current age and also the age at which you want to retire.

- It should also have the details of the amount you will be investing in every month.

- The NPS calculator will also have the returns which you will expect from your investments.

- The monthly pension which you want to receive before your retirement can be given by you. It should be given based on years. This is called an Annuity period.

- The percentage of the wealth invested in the annuity plan means that percentage of the gathered collection of the wealth which you use to buy a pension plan.

How does the NPS Calculator work?

The NPS calculator works on the inputs given by us. Depending upon the inputs you will get the collection that will be gathered by you at the time of your retirement. The collection which will be made by you will be calculated by using the principle of the power of compounding. The PFM will manage the fund of the subscribers. The PFM should be chosen by the investor’s while filling the forms. Two options will be given to the investors under the investment. The options are

- Active Choice: An individual has given the freedom to decide how their pension wealth to be invested depending on the following options.

- Asset Class C: Other than the Government securities the investments will be in fixed income instruments.

- Asset Class E: Investments will be done mainly in equity market instruments.

- Asset Class G: Here the investments will be done in the Government securities.

Many people like to invest their pension wealth in the C or the G asset classes. And a maximum of 50% will invest in the equity which is the Asset Class E.

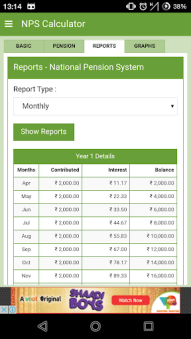

What does the NPS Calculator show?

The details of your investment will be shown by the National Pension Scheme Calculator.

It will show you all the details of the investments done by you. It will also show you the amount you invested by you. The NPS calculator will also provide you the total amount of the collection generated at the time of maturity and also the amount of interest you earned.

The re-invested amount to receive the monthly pension will also be shown by the calculator. The amount which is withdrawn by you will also be displayed by this NPS calculator. Based on the annuity, the amount you will receive monthly will also be shown.

Conclusion:

We hope this information will help full for you. Please share the article with your friends and family to know the information about National Pension system calculator.